SARS Emigration Pin Update

A process called “Financial Emigration” was introduced a few years back whereby emigrating South Africans declare to SARB that they have emigrated and the process to document their exchange control non-resident status is done in coherent with a SARS non-resident declaration. The emigrant’s assets and liabilities need to be declared to SARB to ensure their full financial portfolio is disclosed to ensure any funds can be expatriated once the process is concluded. A SARS Emigration Clearance Certificate was generated for authorised dealers and fund administrators to perform the necessary financial tasks.

In the case of a married couple, their process was completed as one application and only one Emigration Clearance was generated by SARS under the main applicant’s tax number. This created a problem when the secondary applicant wanted to withdraw their policies because an Emigration Clearance was not generated under their own tax number. Emigrants also had their South African bank accounts blocked and it was placed under severe restriction.

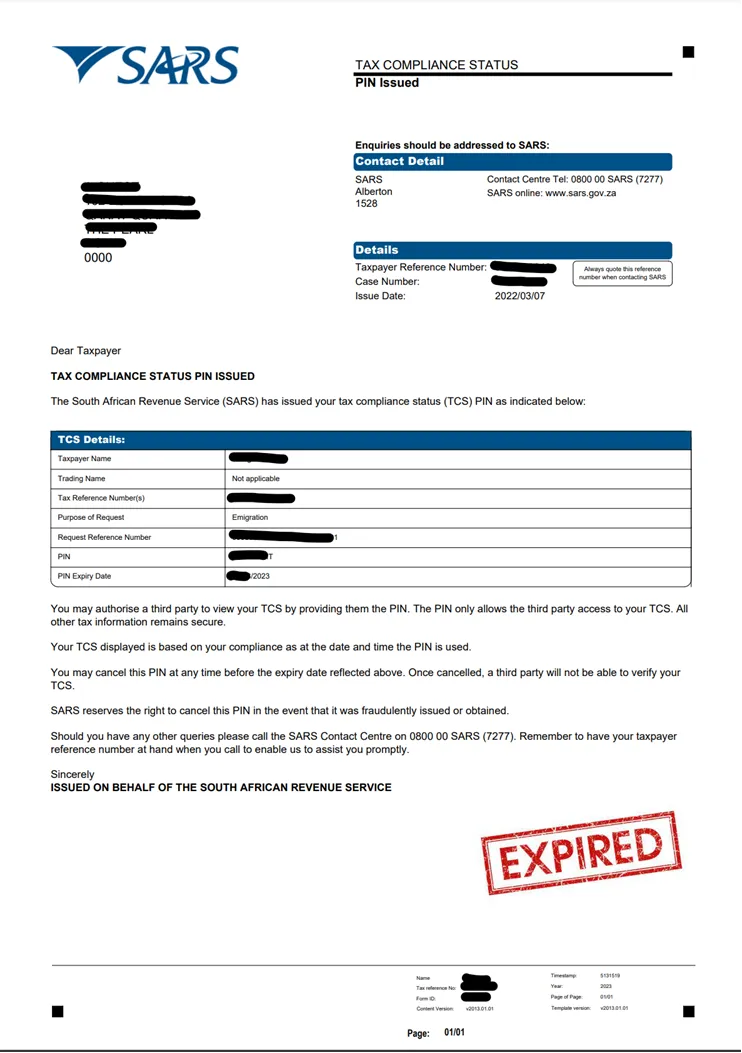

To avoid these issues, the Financial Surveillance Department phased out the concept of “emigration” on the 1st of March 2021 and the process changed to a SARS-only process introducing the new process of “Tax Emigration”. During the process of Tax Emigration, a South African taxpayer who has left the country permanently formalises their Non-Resident Tax Status with SARS and a Notice of Non-Resident Tax Letter is generated together with an Emigration Compliance Document.

The Notice of Non-Resident Tax letter does not have an expiry date, but the Emigration Compliance Document does expire after 12 months of being issued. This allows the Non-Resident taxpayer to expatriate any remaining funds from South Africa for a period of 12 months. However, what happens after the Emigration Compliance has expired and the taxpayer need to move funds such as rental income to a foreign bank account?

Non-Resident taxpayers are still taxed on South African-sourced income and South African authorities need to regulate income received by non-residents to ensure there is no loss to the fiscus. To ensure that income received by non-residents is properly regulated, SARS needs to review all funds being expatriated. For non-residents, this is done by applying for a Foreign Investment Allowance (FIA) compliance with SARS to declare the source of the funds to be expatriated and provide the necessary supporting documents.

Once the FIA has been approved, the authorised dealer can use it to transfer the funds to a foreign bank account with confidence knowing that the funds were reported to SARS. Non-residents are required to go through this SARS compliance process because they do not have a discretionary allowance of R1m at their disposal.

Funds that non-residents might require an FIA to expatriate include the following:

1. Withdrawal of Retirement Policies

2. Inheritance

3. Distributions from a trust

4. Loan repayments

5. Savings transfer

6. Proceeds from the sale of shares

7. Proceeds from the sale of property

It is always important to obtain expert advice in this field of tax, no matter which option one takes. For more info, chat to us!